rpgt exemption malaysia 2019

It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. Starting 1st March 2019 MTD Schedular issued by IRBM is in electronic form namely e-Jadual PCB via e-CP39This module can be accessed from the IRBMs official portal at wwwhasilgovmy.

Exemption Of Rpgt Service Tax From Jan 1 2019 The Star

5 of the total acquisition price where the disposer is a company incorporated in Malaysia or a trustee of a trust or a body of person registered under any written law in Malaysia.

. 如果我2019年1月到6月是打工的然后就resign然后7月开始自己自雇sole proprietor一直到现在 在2020年的3月也报了BE20192019年1月到6月是打工的当时不知道sole proprietor是要报B form 所以现在要怎么办7月到12月2019年自雇的没报到. In 2014 the RPGT was increased for the fifth straight year since 2009. Another huge advantage of Malaysian REITs is the exemption of tax on the moving of properties.

Article 41 and Article 1211 of the Federal Constitution of Malaysia 1957. The Malaysia-United States US Intergovernmental Agreement IGA was signed on 21 July 2021 to improve tax transparency and to implement the Foreign Account Tax Compliance Act FATCA. To comply with the due diligence obligations under the IGA Agreement the Malaysian Government gazetted the following subsidiary legislations on 1.

Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai. Purchase of basic supporting equipment for disabled self spouse child or parent.

Assessment Year 2018-2019 Chargeable Income. When REITs in Malaysia dispose of their assets they do not have to pay real properties gain tax RPGT as well. Prosedur Pengemukaan Borang Nyata Terpinda Available in Malay Language Only Superceded by GPHDN Bil.

Permohonan Surat Penyelesaian Cukai bagi Syarikat Perkongsian Liabiliti Terhad dan Entiti Labuan Available in Malay Language Only Superceded by GPHDN Bil. From the period of 112019 until 31122021 disposal in the sixth year after the date of acquisition of the chargeable asset is 5. Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967.

For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology. Was established on 2522019 and commenced business operation on 142019.

The first accounting period ended on 31122019 9 months. Dividend Income Update 2017. Government of Malaysia V MNMN.

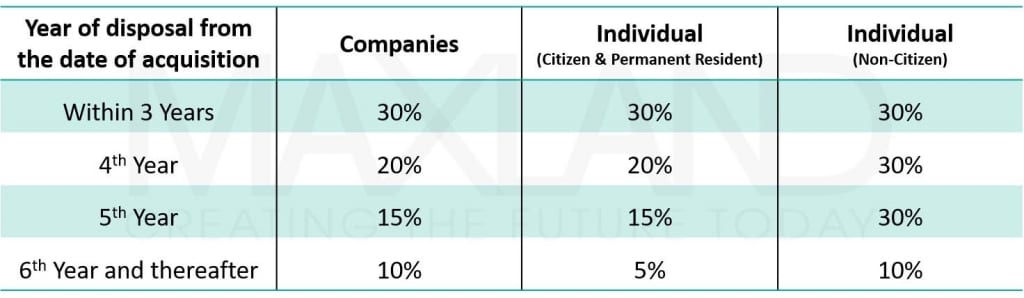

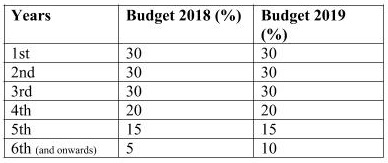

Real Property Gains Tax CKHT English BM. RPGT rates 2019 Citizens Non citizens Company. Dividend Income Update 2019.

Dividend Income Update 2018. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Real Property Gains Tax RPGT Rates.

Ada update paling terbaru di bawah Bajet 2022 Menteri Kewangan Tengku Zafrul mengumumkan bahawa kerajaan tidak lagi akan mengenakan Cukai Keuntungan Harta Tanah atau RPGT bagi pelupusan hartanah oleh individu terdiri daripada warganegara Malaysia. Superceded by the Tax Audit Framework 15122019 - Refer Year 2019. However the amendment does not apply to the disposal of shares under paragraph 34 of Schedule 2 and shares in a real property company under paragraph 34A of Schedule 2.

Once-in-a-lifetime exemption on any chargeable gain from the disposal of a private residence. Superceded by the Public Ruling No. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. With effect from 12102019 where a disposal is subject to tax under Part I of Schedule 5 references to 111970 shall be construed as references to 112013. The RPGT Act defines a private residence as a building or part of a building owned by an individual or occupied as a place of residence.

CLAIMING CAPITAL ALLOWANCE ON THE DEVELOPMENT COST FOR CUSTOMISED COMPUTER SOFTWARE UNDER THE INCOME TAX RULES 2019. Garis Panduan Bagi Kelulusan Ketua Pengarah Hasil Dalam Negeri Di Bawah Subseksyen 446 Akta Cukai Pendapatan 1967 Bertarikh 5 September 2019 Pindaan subperenggan 61iv 4. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber.

On the First 5000. Garis Panduan Bagi Permohonan Untuk Kelulusan Di Bawah Seksyen 446 Akta Cukai Pendapatan 1967 Bertarikh 15 Mei 2019 5. Dividend Income Update 2016.

Real Property Gains Tax RPGT Rates. First it was suspended temporarily from April 2007 to December 2009 and reintroduced in 2010. Pengecualian apa-apa surat cara berkenaan dengan terbitan jaminan dan perkhidmatan berhubung dengan terbitan Bon Yen Jepun Malaysia - Siri A 2019 yang Dijamin oleh Bank Jepun untuk Kerjasama Antarabangsa Untuk Pelabur Institusi Sahaja Tekikaku Kikan Toshika Gentei oleh Kerajaan Malaysia yang disempurnakan pada atau selepas 26 Februari.

Find out how much you will be taxed when you sell your property in Malaysia using our online RPGT calculator aka. 5001 - 20000. Order 92 Rule 4 of the Rules of Court 2012.

RM10000 or 10 of the chargeable gain whichever is greater. Calculations RM Rate TaxRM 0 - 5000. Tax Audit Framework available in Malay version only.

EXEMPTION NO9 ORDER 2017 PUA 3232017 07122017. Pada tahun 2014 kadar CKHT telah dinaikkan bagi 5 tahun berturut-turut sejak 2019. Then theres another revision to the RPGT under Budget 2020 as well as the Exemption Order.

In 2019 the RPGT rates have been revised. Now here is some history about the RPGT. What are the RPGT rates of 2019.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. The company must submit e-CP204 for the Year of Assessment 2019 not later than 3062019 which is three 3 months from the date of commencement of its business operations.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Real Property Gains Tax RPGT Rates. Company with paid up capital not more than RM25 million.

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Taxplanning Rpgt Exemption The Edge Markets

Newsletter 39 2019 Income Tax Exemption No 8 Order 2019 Page 001 Jpg

Understanding Rpgt Legally Malaysians

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Djl Financing The Calculation Of Memorandum Of Transfer Facebook

Real Property Gains Tax Rpgt Guide For The Year 2020 2021 In Malaysia

The Ultimate Real Property Gain Tax Rpgt Guide

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Malaysia Law Firm With More Than 30 Lawyers Since 2009 In Pj Kl Johor Penang Perak Negeri Sembilan

Newsletter 28 2019 Income Tax Exemption No 3 Page 001 Jpg

Budget 2019 No Big Impact Expected From Higher Rpgt Say Industry Experts Edgeprop My

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Malaysia Rpgt Stamp Duty 2019 Mypf My

Gl Property Consultancy Real Property Gains Tax Rpgt Is A Form Of Capital Gains Tax That Homeowners And Businesses Have To Pay When Disposing Of Their Property In Malaysia This Means

Solved Siblings Aishwarya Dhanya And Ganesh Own Properties Around Course Hero

0 Response to "rpgt exemption malaysia 2019"

Post a Comment